27+ Borrowing capacity mortgage

Borrowing capacity income - expenses x 035. Pre-credit crunch the amount you could borrow as a mortgage was largely defined as a multiple of your annual salary.

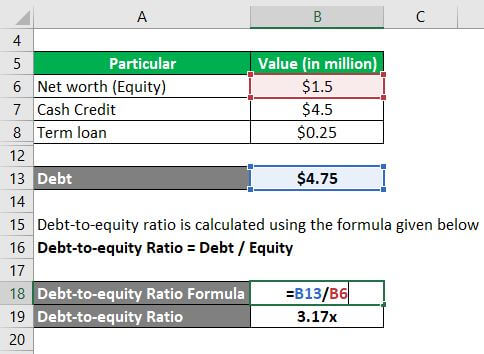

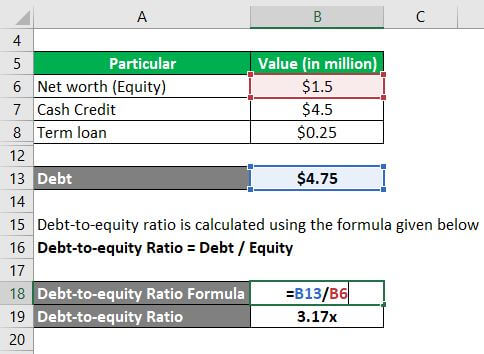

Interpretation Of Debt To Equity Ratio Importance Of Debt To Equity Ratio

For example you were offered a.

. The Bank of Spain advises that the. A Mortgage Capacity Report is a document which provides details from a number of lenders on how much you can borrow as a single applicant. When the time comes to assess your borrowing capacity the first indicator used by financial institutions is the gross debt service or GDS.

Increase your borrowing power by reducing the number of additional features on your home loan extending your loan term and improving your credit score. A households borrowing should not exceed 30-35 of its total income. Joint Mortgage Capacity Report.

Different lenders require different. But a rough calculation is simple. Estimate how much you can borrow for your home loan using our borrowing power calculator.

Lenders commonly discuss borrowing capacity with client but that does not mean it is your max or what you would like. Our model assumes that banks accept a debt ratio of borrowing costs all debts combined to net income of 40 to 45. This ratio takes your annual housing.

Borrowing capacity is the maximum amount of money you can borrow from a loan provider. Everyones borrowing power for a home loan is different. In addition banks generally do not grant a mortgage if your monthly.

This is usually required by the courts during. Whats my borrowing capacity. One of the best ways to increase your borrowing power is by having a larger deposit for your home.

As an expat or foreign national your borrowing power will vary from a permanent resident. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

View your borrowing capacity and estimated home loan repayments. Have a Larger Deposit. Typically borrowing power depends on.

Here is the formula. Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of the individuals remuneration. A mortgage broker can find out your max because they have the.

An important factor in applying for a mortgage is. The amount you can. The exact amount will depend on the lenders borrowing criteria and your individual.

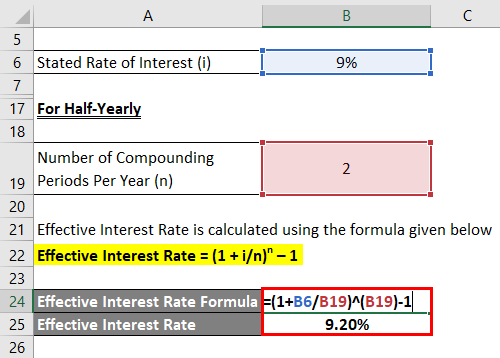

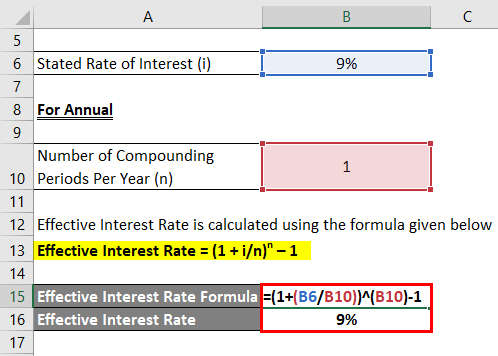

Effective Interest Rate Formula Calculator With Excel Template

Secured Loan Vs Unsecured Loan Top 5 Differences To Learn

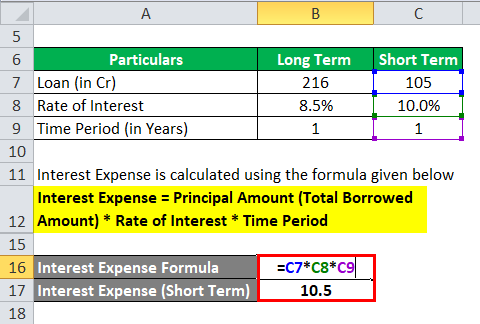

Interest Expense Formula Calculator Excel Template

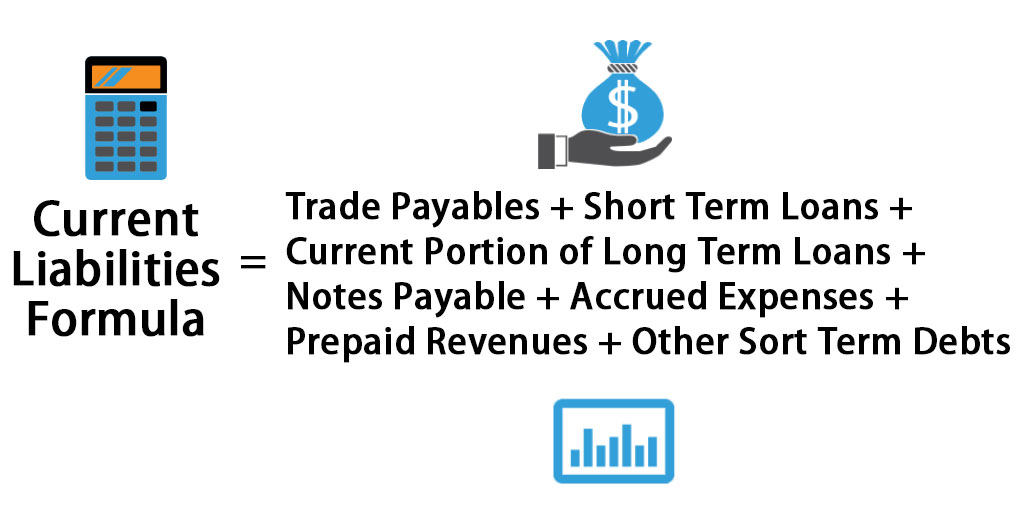

Current Liabilities Formula How To Calculate Current Liabilities

Effective Interest Rate Formula Calculator With Excel Template

Capital Structure Complete Guide On Capital Structure With Examples

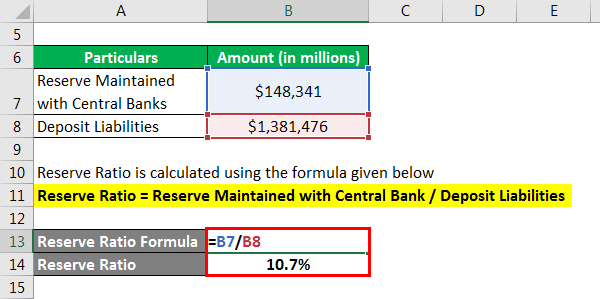

Reserve Ratio Formula Calculator Example With Excel Template

Effective Annual Rate Formula Calculator Examples Excel Template

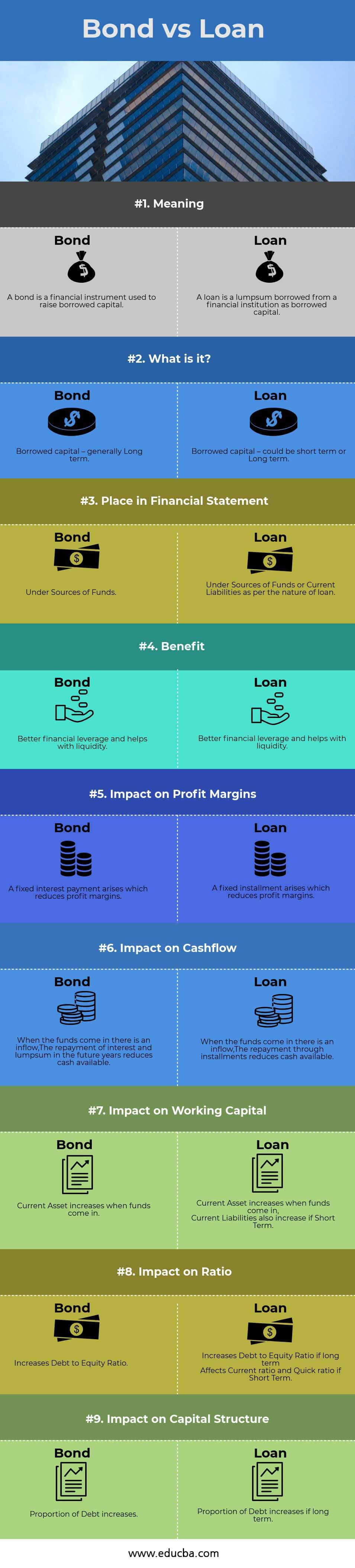

Bond Vs Loan Top 9 Differences To Learn With Infographics

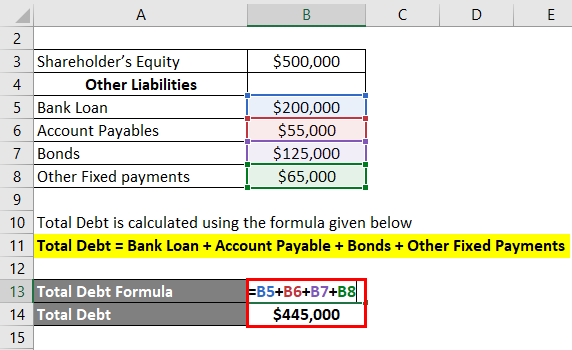

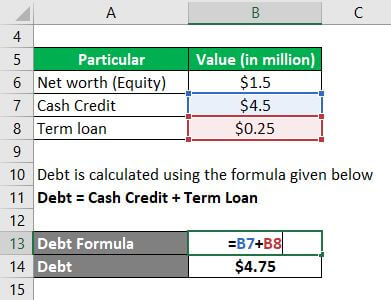

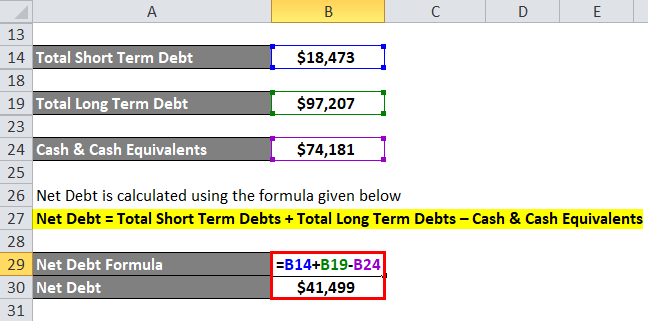

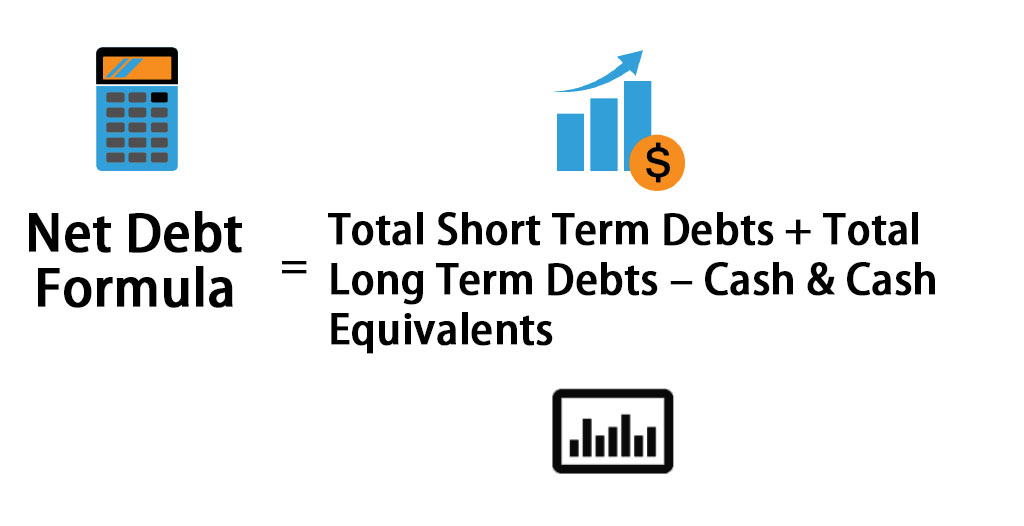

Net Debt Formula Calculator With Excel Template

Debt To Income Ratio Formula Calculator Excel Template

Effective Interest Rate Formula Calculator With Excel Template

Secured Loan Vs Unsecured Loan Top 5 Differences To Learn

Capital Structure Complete Guide On Capital Structure With Examples

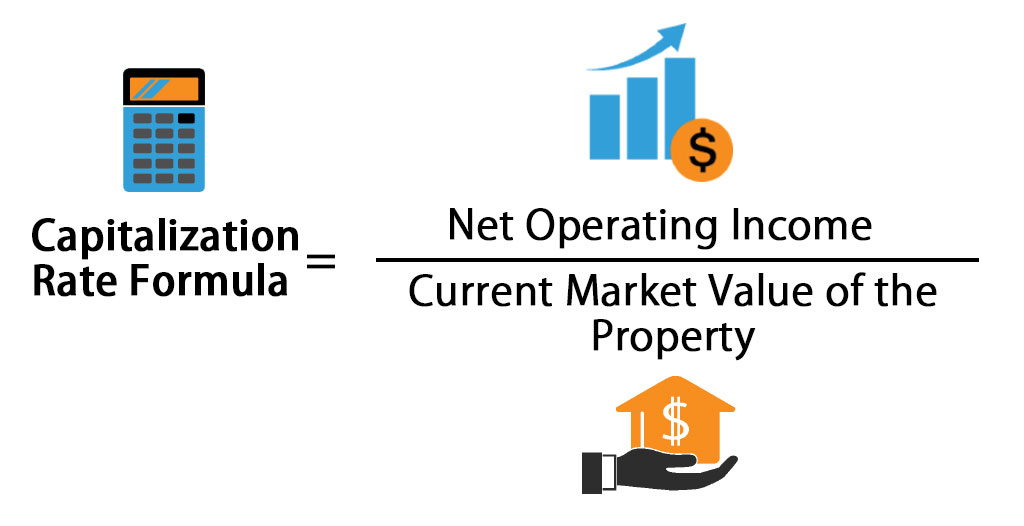

Capitalization Rate Formula Calculator Excel Template

Net Debt Formula Calculator With Excel Template

27 Consumer Debt Statistics Depicting The Crisis Fortunly